Key questions and answers for the Fagura Equity Investment Round

We’ve thought about the main questions and answers that investors might have in this round, and we’ve listed them below. WE hope this will be useful for you:

- How can I invest in equity at Fagura?

If the amount you want to invest exceeds EUR 50k, please send an email to Cristian at cristian.pasa@fagura.com. Otherwise, you need to follow the following steps:

A. Create an account on Seedrs (details here)

B. Pass the digital identification and the risk test

C. Find the Fagura Campaign (link here)

D. Send your money by a bank transfer (if you have an EURO account in Moldova): it is not necessary to have the amount available in your Seedrs account immediately to finalize the investment. You can top it up in 1-2 days thereafter. You cannot use a bank card issued in Moldova to top up your Seedrs account because Stripe (the processing company they use) does not accept the cards issued in Moldova. There should be no such problems with the cards issued in the EU/UK.

E. Transfer the money to your Seedrs account within a maximum of 7 days to complete your investment (if you did not transfer it initially). Pay attention to transfers from the Republic of Moldova, they can take up to 3 working days.

- What is the exit strategy?

Following an investment in Fagura equity through seedrs.com, there are 3 main ways to exit/capitalize on the investment:

- Seedrs Secondary market – opened once a month. Shares can be sold there to other Seedrs customers. The possibility of adding a profit margin above the face value is provided. After the first crowdfunding round at Fagura, for instance, such sales took place with an addition of up to 500% from the nominal value of the shares in the first round. This is not guaranteed however and will depend on the willingness of other investors to make the purchase.

- Acquisition of Fagura OU by another company: all shareholders will be compensated based on the percentage share held and the value at which the transaction will be made. This is a mid-long term scenario (3-5 years).

- Listing Fagura on an international stock exchange: the shares will be transformed into stocks at the market value, and these will be able to be traded by each individual investor. This is a long term scenario (more than 5 years).

- Will I receive dividends annually?

Fagura is a startup that will invest in its growth for the foreseeable future. Thus, all company profits will be reinvested in scaling the business, which is why we do not plan to pay annual dividends. The present investment should be seen as a long term capital gain one (as per explanations above).

- How can I fund the investor account on Seedrs?

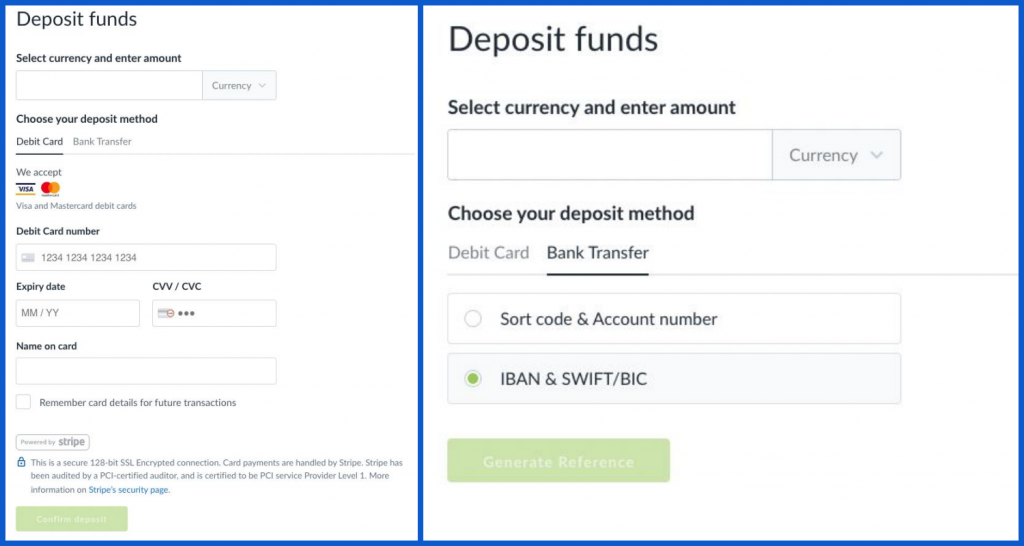

Bank card or bank transfer. Images below:

- The bank asks me for a confirmation document to process the bank transfer, what can I show them?

If the bank you use asks you for confirmation documents for this investment, you have two options:

- When you set up the investment on Seedrs, you choose bank transfer as the method, and Seedrs sends you an email with all the investment details. You can save this email as *.pdf and use it as a confirmation for the bank. The bank should normally processes the payment as a result;

- If you transfer a larger amount and the bank wants other confirmations, you can write to cristian.pasa@fagura.com and Fagura will sign a Term Sheet with you, in which the conditions of the investment will be explained, so that you can have a signed document to present to the bank.

- How long will the investment round last?

The investment round will be open until December 15, 2022 at the latest. Fagura also reserves the right to close it sooner without notifying investors beforehand. This can be caused, for example, by reaching the round budget. The funding campaign will be followed by a bureaucratic procedure of approving and signing the documents, transferring the money raised from Seedrs to the Fagura accounts, issuing the investor certificates by Seedrs. The whole process might take 2-3 months until you get to see the shares issued by Seedrs in your account.

- What are the risks of the investment?

We will list below the biggest potential risks associated with the investment, a fact that you are warned about in all the communication that Seedrs and Fagura do:

- The biggest risk is that Fagura becomes insolvent / declares default. The team at Fagura will most certainly make every effort to avoid this scenario from happening. We also have some team members that are investing during this round as well. But it is important to understand that seed investments are risky and hence such a default possibility exists.

- There is a risk that Fagura will not grow fast enough and attract a new round of funding at a similar or lower valuation than the current one. This will cause a potential decrease in the value of the investment.

- Investing on Seedrs does not come with a guarantee of exit – the sale of shares may take a shorter or longer time, depending on the interest of other investors in buying the shares you own. Similarly, 5-7 years may pass before Fagura is acquired by another company or listed on the stock exchange. It is impossible to predict this.

- More risks associated with investing on Seedrs can be found at this link.

- How much could I earn if I invested, e.g. 10 thousand euros?

When calculating the return of an investment, the following aspects must be taken into account: the value of the company after the current round (namely the value of EUR 5 million plus the amount that will be raised in the current round), the value after the next round and the time of the investment.

For example: EUR 10k in the previous round would have represented around 0.43% of Fagura. If Fagura closes the current round with 700k EUR raised, the value of the company would be 5.7 million EUR post-money. That 0.43% (based on the investment in the previous round) will now represent 0.36%, but of a higher company value. Respectively, those 10k EUR invested will now represent around 21k EUR. Thus, within a year, the value of your investment increased by more than 2X. Of course, it is not guaranteed that the value will double every year in the future. It might grow even faster (eg: 10X in the coming years), but it is also possible it will grow slower. Plus, you have to take into account that Seedrs may charge certain fees, which should be checked individually by each investor.

- Can I trust Seedrs and the investment made through them?

Absolutely. Seedrs.com is an FCA regulated platform in the UK. FCA is one of the most rigorous financial regulators in the world.

Leave a Reply